how to find retained earnings

Formula to Calculate Retained Earnings

Retained Earnings formula calculates cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company and it is calculated by subtracting the cash dividends and stock dividends from the sum of beginning period retained earnings and the cumulative net income earned.

Retained Earnings (RE) = Beginning Period RE + Net Income (Loss) – Cash Dividend – Stock Dividend

Where,

- Beginning Period RE can be found in the Balance sheet under shareholders' equity.

- Take Net Income / (Loss) from Profit and Loss Statement.

- Cash Dividend Cash dividend is that portion of profit which is declared by the board of directors to be paid as dividends to the shareholders of the company in return to their investments done in the company. Such a dividend payment liability is then discharged by paying cash or through bank transfer. read more , if paid any, can be figured out from financing activity from cash flow statement.

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Retained Earnings Formula (wallstreetmojo.com)

Explanation

Retained Earnings is very important as it reports how the company is growing with respect to its profit.

- An investor can make an idea through trend analysis Trend analysis is an analysis of the company's trend by comparing its financial statements to analyze the market trend or analysis of the future based on past performance results, and it is an attempt to make the best decisions based on the results of the analysis done. read more whether the company is retaining its profit or its paying part of profits as dividends.

- As per the equation, Retained earnings depend upon previous year figures.

- The figure may be positive or negative, depending upon inputs in the formula. If the company suffered a loss last year, then it's beginning period RE will start with negative.

- Similar to the second input is current year profit or loss, which may be positive or negative depending upon how the company performed.

- In case a company is a dividend-paying company, and hence even this could lead to a negative retained earnings if the dividends paid is large.

Calculation Examples of Retained Earnings

You can download this Retained Earnings Formula Excel Template here – Retained Earnings Formula Excel Template

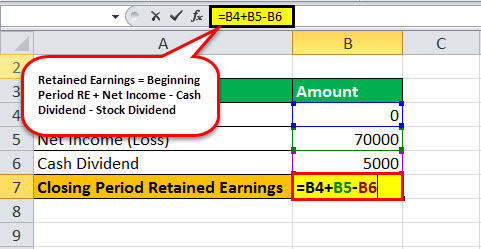

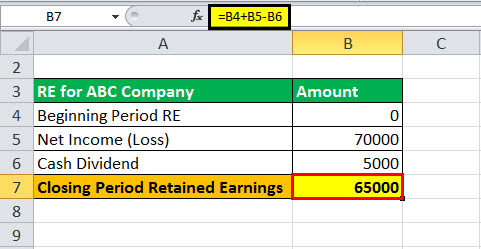

Example #1

Below given is the financial statement Financial statements are written reports prepared by a company's management to present the company's financial affairs over a given period (quarter, six monthly or yearly). These statements, which include the Balance Sheet, Income Statement, Cash Flows, and Shareholders Equity Statement, must be prepared in accordance with prescribed and standardized accounting standards to ensure uniformity in reporting at all levels. read more extract from ABC company. Do the Calculation of the Retained Earnings using the given financial statements.

Given,

- Beginning Period Retained Earnings = $0

- Net Income from the Income Statement = $70,000

- Cash Dividend = $5,000

So, the calculation of Retained Earnings equation will be as follows –

Retained Earnings will be-

Therefore, Retained Earnings =65000

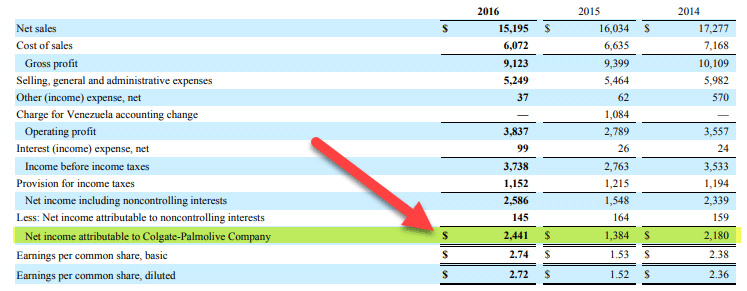

Example #2 – Colgate

Let us now calculate the retained earnings of Colgate using the formula that we learned earlier.

Below is the snapshot of shareholders' equity items of Colgate.

Retained Earnings at the beginning period = $18.861 million

Below is the snapshot of Colgate's Income Statement.

We note that Colgate's Net Income is $2,441 million.

We also note that Colgate's Dividends were $1380 during the period.

- Ending Retained Earnings formula (2016) = Retained Earnings (2015) + Net Income (2016) – Dividends (2016)

- Ending Retained Earnings formula = 18,861 + 2441 – 1380 = $19,922 million

Calculator

You can use the following Retained Earnings Calculator-

| Beginning Period RE | |

| Net Income (Loss) | |

| Cash Dividend | |

| Stock Dividend | |

| Retained Earnings Formula = | |

| Retained Earnings Formula = | Beginning Period RE + Net Income (Loss) − Cash Dividend − Stock Dividend | |

| 0 + 0 − 0 − 0 = | 0 |

Use and Relevance

- Retained Earnings Formula calculates the current period Retained Earning Retained Earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company. It is shown as the part of owner's equity in the liability side of the balance sheet of the company. read more by adding previous period retained earnings to the Net Income (or loss) and then subtracting the dividends paid during the period.

- Whenever a company generates a surplus, it always has an option to pay a dividend to its shareholders or retain with itself.

- Further, if the company is making huge profits, then its shareholders would expect regular income in the form of dividends Dividend is that portion of profit which is distributed to the shareholders of the company as the reward for their investment in the company and its distribution amount is decided by the board of the company and thereafter approved by the shareholders of the company. read more for risking their capital.

- If the company expects more investment Opportunities and will earn more than its cost of capital, then it would intend to retain the funds instead of paying dividends.

- And if a company thinks the expected returns from opportunities will yield low returns, then it will wish to pay them as a dividend to its shareholders.

- Among a few factors, thoughtful consideration could be given to trends and past performance as to how efficiently retained earnings were utilized by the company while looking for long term value investments or dividend payouts The dividend payout ratio is the ratio between the total amount of dividends paid (preferred and normal dividend) to the company's net income. Formula = Dividends/Net Income read more .

Recommended Articles

This has been a guide to Retained Earnings Formula. Here we discuss how to calculate Retained Earnings along with practical examples and explanation. You can learn more about accounting from the following articles –

- Shareholder's Equity Formula

- What is Appropriated Retained Earnings?

- Unappropriated Retained Earnings Meaning

- Pro-Forma Earnings

how to find retained earnings

Source: https://www.wallstreetmojo.com/retained-earnings-formula/

Posted by: gunndentoory1961.blogspot.com

0 Response to "how to find retained earnings"

Post a Comment